If you’re living paycheque to paycheque or struggling to cover unexpected bills, building an emergency fund from £0 may seem impossible—but it isn’t. In today’s unpredictable world, having an emergency fund is one of the smartest steps you can take to protect your financial wellbeing.

In this guide, we’ll walk you through how to start saving money even when you feel like you have none. Whether you’re dealing with debt or simply want to take control of your finances, this step-by-step plan will help you build an emergency savings buffer for peace of mind.

What Is an Emergency Fund?

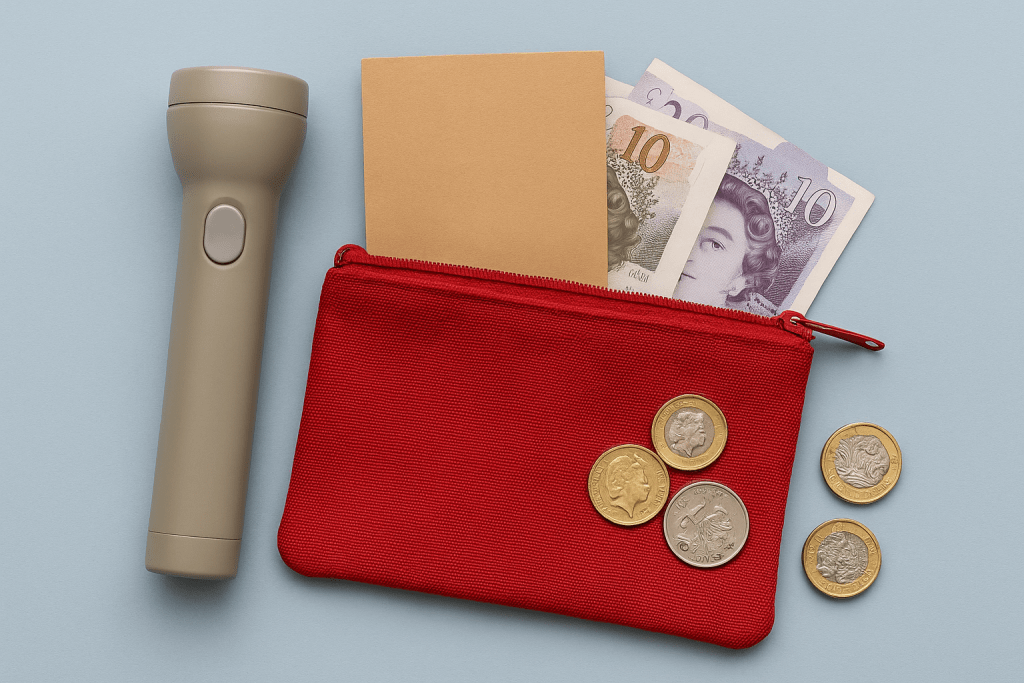

An emergency fund is a pot of money set aside to cover unexpected expenses — such as car repairs, medical bills, or losing your job. It gives you peace of mind and helps you avoid relying on credit cards or payday loans when life throws you a curveball.

Why You Need an Emergency Fund

- ✅ Avoid debt during emergencies

- ✅ Stay in control of your finances

- ✅ Reduce stress and increase financial stability

According to MoneyHelper (supported by the UK government), everyone should aim to build an emergency fund that covers 3 to 6 months of essential expenses.

Step 1: Set a Realistic Emergency Fund Goal

Start small. Your first goal should be to save £500 to £1,000 — enough to handle basic emergencies like a broken appliance or unexpected travel.

Once you hit that target, gradually build up to 3 months’ worth of expenses.

Before you start saving, figure out how much you need.

- Add up your essential monthly expenses: rent, groceries, utilities, transport, insurance.

- Multiply by 3 or 6, depending on how much security you want.

👉 Example: If your monthly essentials cost £1,200, your target emergency fund should be between £3,600 and £7,200.

Step 2: Track Your Spending

Before you can save, you need to understand where your money is going.

Use free apps like:

- Emma – Budgeting and expense tracking

- Moneyhub – Visualise spending habits

- Starling Bank Spending Insights feature

Alternatively, a simple spreadsheet can help you see how much you could realistically put aside each month.

Step 3: Open a Separate Savings Account

Keep your emergency fund separate from your daily spending money. Look for:

- High interest savings accounts

- Instant access accounts

- No penalties for withdrawals

Compare the best options on MoneySavingExpert’s savings account comparison:

- Chase UK: 4.1% AER (easy access)

- Nationwide: 4.25% AER (limited withdrawals)

- Monzo: 4.5% AER on savings pots

All are FSCS protected up to £85,000.

Avoid current accounts or investment platforms for this purpose—your emergency fund should be liquid and risk-free.

Step 4: Start Small—Even £1 Counts

If you’re starting from zero, the key is consistency, not amount.

Try these micro-saving ideas:

- Round up transactions using apps like Plum or Monzo

- Save £1 per day challenge

- Sell unused items online (Facebook Marketplace, Vinted, eBay)

- Use cashback apps like TopCashback or Quidco

Even £5 per week adds up to £260 a year—enough to handle minor emergencies.

Step 5: Budget with Saving in Mind

Use the 50/30/20 rule to manage your income:

- 50% for needs (bills, rent, groceries)

- 30% for wants (entertainment, eating out)

- 20% for saving and debt repayment

If that’s too ambitious, try the 80/10/10 rule instead.

Even if you can’t hit 20%, start with just £10 per week. Consistency is more important than amount.

Free UK budget planners:

Step 6: Automate Your Savings

Set up a standing order or direct debit to move money into your emergency fund the day you get paid.

Even if it’s just £10 per month, automating the process removes the mental effort and builds habit over time.

Tip: Some banks like Monzo, Starling, and Chase UK offer “round-up” features that save your spare change automatically.

Step 7: Cut Expenses and Redirect to Savings

Lowering your monthly outgoings can free up extra money.

Quick wins:

- Switch to cheaper energy or broadband providers (Uswitch). Use price comparison tools like Compare the Market

- Cancel unused subscriptions (check your Apple/Google accounts!)

- Cook at home instead of ordering takeaway

- Use public transport or walk instead of Uber

- Use cashback sites like TopCashback or Quidco

Redirect these savings straight into your emergency pot.

Step 8: Set Milestones and Celebrate Wins

Breaking your goal into small chunks keeps motivation high.

Example:

- Save £100 → Celebrate with a free reward (e.g., movie night at home)

- Hit £500 → You’re now covered for most minor emergencies!

- Reach £1,000 → Peace of mind is building

Track your progress using savings apps or printable trackers. Share your goal with an accountability buddy or join a savings challenge for extra motivation.

Step 9: Boost Your Savings with Side Income

Saving from your main income isn’t your only option. Ideas include:

• Sell handmade or second-hand goods online

• Offer freelance services (writing, design, tutoring)

• Sign up for delivery gigs (UberEats, Deliveroo)

• Pet sitting or dog walking via platforms like Rover

Just £50 extra per month can significantly speed up your savings goal.

Bonus Tip: Protect Your Emergency Fund

Once you’ve saved it, don’t dip into it unless it’s truly an emergency. Car repairs? Yes. Black Friday sale? No.

If you use it, make a plan to top it back up as soon as possible.

Should You Keep It in a Cash ISA?

A Cash ISA is a tax-free savings account.

Pros:

• Interest earned is tax-free

• FSCS protection up to £85,000

• Can be instant access (check account terms)

As of 2025, you can save up to £20,000 per year in ISAs. Compare Cash ISAs with instant access features to ensure you can withdraw during emergencies.

When Should You Save vs. Pay Off Debt?

If your debt interest is higher than 10% APR, it’s usually best to focus on paying it down first. If your debt is low-interest (e.g., <5% APR), start by building a small emergency fund of £500–£1000.

Use this simple decision guide:

● High-interest debt (>10%)? → Prioritise debt, save £500 only

● Moderate debt (5–10%)? → Split: pay debt + save £50/month

● Low-interest debt (<5%)? → Build emergency fund alongside

Building an Emergency Fund from £0 Is Possible

It may take time, but starting is more important than waiting until you have “enough”. With small steps and smart budgeting, anyone can build an emergency savings buffer—even from zero.

An emergency fund is your financial safety net, helping you stay in control when life throws a curveball. Start small, stay consistent, and give your future self one less thing to worry about.

FAQs

How much should be in an emergency fund UK?

Experts recommend 3–6 months of essential expenses, which typically ranges between £3,000 to £6,000 for most UK households.

Where should I keep my emergency fund?

In a separate, instant-access savings account with a competitive interest rate. Avoid locking it away in fixed-term accounts or risky investments.

What if I have debt—should I still save?

Yes. Even while paying off debt, it’s smart to save a small emergency fund (e.g. £500–£1,000) to avoid further borrowing during crises.

*The article above includes general information and should not be taken as financial advice.